Buying a Foreclosed Home: A Practical Step-by-Step Guide

Why Foreclosures Matter and How to Use This Guide

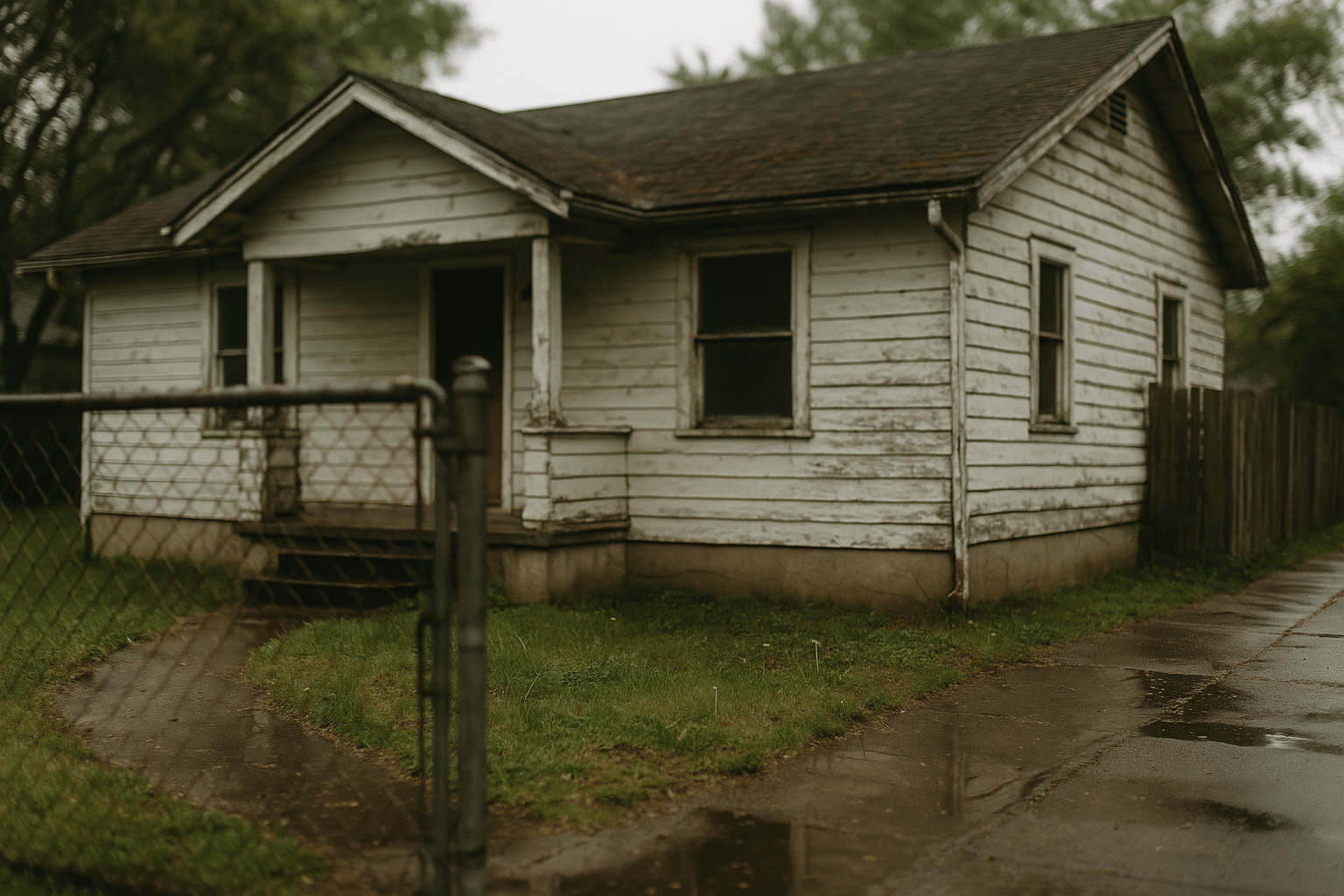

Foreclosed homes sit at the crossroads of value and complexity. They can offer meaningful price advantages compared with similar properties, yet they also come with legal wrinkles, condition unknowns, and tighter timelines. If you approach them like a pro—systematic, patient, and data-driven—you can reduce uncertainty and make smarter decisions. Think of this guide as a flashlight in a dusty attic: not everything you discover will be pretty, but the clarity helps you plan and act with intent.

To keep you oriented, here is the outline we’ll follow before expanding each part with examples, cautions, and practical checklists:

– Where foreclosure deals come from: stages, sources, and timing

– A due diligence toolkit: legal, physical, and financial checks

– Money and negotiation: funding paths, offer math, and auction tactics

– From contract to keys: closing, renovation priorities, and risk control

– A focused wrap-up with next steps tailored to your goals

Why this matters now: inventory in many areas remains tight, and affordability is a core concern for first-time buyers and investors alike. Distressed inventory sometimes trades at a discount, but not for free—buyers pay with extra homework, limited access for inspections, as-is conditions, and occasionally rigid terms. Industry snapshots often show lender-owned properties and auction sales transacting for a modest markdown relative to nearby comparables, with the actual spread largely explained by condition, location, and urgency. The point is not to chase a bargain at any cost but to purchase value you can verify. Throughout this guide, you’ll see how to frame decisions with numbers, compare options fairly, and protect your downside. If you enjoy methodical planning, you’re already halfway to making foreclosures less intimidating and more actionable.

Where Foreclosure Deals Come From: Stages, Sources, and Timing

The foreclosure pipeline moves through distinct stages, each with its own rules, risks, and price dynamics. Understanding the sequence helps you match your approach to the opportunities you’re most comfortable pursuing.

Pre-foreclosure: This early stage begins when an owner is behind on payments but before the property is scheduled for sale. Opportunities can appear as short sales or distress-driven listings. Advantages include potential access to the interior, negotiated timelines, and a chance to resolve issues collaboratively. Trade-offs include longer approvals, added paperwork, and a sale price that must satisfy the lender’s net requirements. Buyers who are patient and empathetic often find this stage allows for the most thorough due diligence.

Auction (trustee or sheriff sale): Here, the property is offered at a public sale, typically “as-is,” with limited or no interior access. Pricing can be compelling, and in some counties the opening bid may reflect the unpaid balance plus fees. However, bidding rules are strict: expect same-day or next-day deposits, proof of funds, and short closings. Title issues can be more common, and you may inherit occupants. Some auctions include a buyer’s premium that adds 5–10% to your cost, so always model that into your maximum bid. The process rewards preparation and punishes guesswork.

Lender-owned (post-auction): If a property doesn’t sell at auction, it may return to the lender’s inventory and be listed on the open market. Pros include more standardized contracts, wider financing options, and sometimes limited opportunities for inspections. Cons include “as-is” clauses, firm addenda, and competitive bidding when a home is priced to move. Typical discounts compared with nearby, move-in-ready homes often range from small to moderate, with the gap driven by condition and location rather than the “foreclosure” label itself.

Where to find leads without chasing hunches:

– County notices and public records for sale schedules and defaults

– Local listing databases and brokerage networks for lender-owned inventory

– Community relationships—contractors, property managers, and closing agents who hear early whispers of distress

– Neighborhood reconnaissance: signs of deferred maintenance, boarded windows, or overgrown yards (always observe local laws and respect privacy)

A useful mental model: match your appetite for uncertainty to the stage. If you need interior access and predictable timelines, lender-owned inventory may fit. If you can live with limited access but want pricing power, auctions might appeal—provided you budget for title work and possession. If you value flexibility and dialogue, pre-foreclosure negotiations may be your zone. Your path should reflect your tolerance for unknowns and your capacity to investigate before committing funds.

Due Diligence Deep Dive: Legal, Physical, and Financial Checks

Buying a foreclosed home is a research project first and a purchase second. Your goal is to transform uncertainty into a quantified plan. Start with the legal canvas: who owns the property now, what liens survive the sale, and whether any redemption window allows the prior owner to reclaim the home after closing. The answers vary by state and sale type, so confirm procedures with local professionals who handle distressed property transactions regularly.

Key legal checks to complete before you spend a dollar on bids or offer prep:

– A title search that screens for unpaid property taxes, municipal fines, junior and senior liens, and recorded easements

– Verification of the sale format and whether it clears certain liens or leaves them in place

– Inquiry into occupancy status, including whether tenants have rights that require formal notice

– Confirmation of redemption rights and timelines, if applicable

– Review of local transfer taxes, buyer premiums, and deed types used at sale

Physical due diligence ranges from curbside observations to full inspections if access is granted. Without interior access, use conservative assumptions. Exterior clues—stained soffits, missing flashing, sagging gutters, wavy rooflines, and uneven grading—often hint at moisture issues inside. If you gain access, prioritize the big-ticket systems: roof, foundation, electrical capacity, plumbing, HVAC, windows, and drainage. Light cosmetic work might be 10–20 dollars per square foot in many markets, while moderate rehabs can run 20–60 dollars per square foot. Major structural or mechanical replacements can push well beyond those ranges; plan contingencies accordingly.

Financial diligence translates observations into numbers you can defend. Establish the after-repair value (ARV) using truly comparable sales adjusted for condition, size, and features. Then stack costs: purchase price, closing expenses, permits, insurance, holding costs, utilities, taxes, financing charges, and renovations. Add a contingency line—often 10–20% of rehab—for surprises. Your maximum allowable offer should protect a margin that suits your goals, whether that’s affordability for a long-term home or adequate cushion for an investment.

Finally, evaluate the neighborhood’s trajectory. Are nearby homes well maintained? Are days on market shrinking or expanding? Do schools, parks, and transit improve long-term livability? A fair deal on a neglected street can become a fair headache. Conversely, a dated property on a stable block may reward patience. In short, legal clarity, physical reality, and financial discipline are the three legs of a sturdy decision.

Money and Negotiation: Funding Paths, Offer Math, and Auction Tactics

Foreclosure purchases hinge on matching money to the timeline. Some sales require rapid closings and large deposits; others follow more conventional schedules. Cash reduces friction, but well-prepared financing can compete if you line up documents early. Renovation-friendly loans can bundle repairs, while private funding can bridge short windows—just model interest and fees so the speed you buy with doesn’t become the cost you regret.

Offer math begins with discipline. If the ARV is 300,000 and you estimate 45,000 for rehab plus 15,000 for all other costs, your base exposure is 60,000. If you need a 10% cushion relative to ARV for comfort, that’s 30,000. Your maximum offer becomes ARV minus total costs minus cushion: 300,000 − 60,000 − 30,000 = 210,000. Adjust for market tempo: in a fast area with multiple offers, you might compress the cushion slightly if your inspections are thorough and the home is straightforward; in a slower area or with access limits, expand the cushion.

Expectations by sale type:

– Pre-foreclosure: standard earnest money (often 1–3%), contingencies possible, timelines vary with lender approval

– Auction: proof of funds, a nonrefundable deposit at the event (commonly 5–10%), limited or no contingencies, short closing windows (sometimes 10–30 days)

– Lender-owned: earnest money comparable to local norms, “as-is” clauses, addenda governing repairs and credits, closing in roughly 20–45 days

Negotiation in distressed contexts is less about charm and more about certainty. Sellers—whether individuals under pressure or institutions clearing inventory—prefer offers that close as written. Strengthen your package with clean contingencies, documented funds, and realistic inspection periods. If you need repairs credited, attach contractor estimates rather than opinions. Consider appraisal gap strategies if comparable sales lag behind improving conditions, but cap your exposure in writing.

Auction tactics are a sport of preparation. Visit the property exterior ahead of time, read the auction terms twice, and set a walk-away number that you won’t cross. If a buyer’s premium applies, fold it into the bid math before the first paddle rises. Some bidders try to intimidate; let them perform while you do arithmetic. Winning is paying a price that fits your plan, not simply outbidding the room. If you leave empty-handed but disciplined, you’ve built momentum for the next opportunity.

From Contract to Keys: Closing, Renovation Priorities, and What Comes Next

Once your offer sticks or your bid wins, the clock accelerates. Begin by scheduling the title work immediately and verifying that the deed you’ll receive matches your expectations for lien clearance. Order insurance quotes, confirm utilities, and lock your closing funds path. If occupants remain, coordinate lawful notice and timelines in alignment with local rules—respectful communication and adherence to process protect both you and them. Create a closing checklist so nothing slips during the sprint.

Renovation priorities should follow a safety-first, structure-second, cosmetics-third sequence. Stabilize the property: secure doors and windows, address active leaks, and correct hazards such as exposed wiring or gas issues. Then move to major systems and water management—roof, gutters, grading, and drainage—which safeguard everything below. After that, budget for kitchens, baths, flooring, and paint. When funds are limited, think in layers: tackle what prevents further damage first, then what improves functionality, and only then what elevates appearance. The goal is a home that lives well and lasts, not just one that photographs nicely.

Practical post-closing steps that reduce risk and stress:

– Change locks, test smoke and carbon monoxide alarms, and service mechanicals

– Photograph each room before work begins to document condition

– Pull permits where required and schedule inspections early to avoid delays

– Order materials with lead times in mind so crews aren’t idle

– Track every expense to compare against your original model and refine future bids

As you near completion, revisit your strategy. If this is your residence, consider improvements that boost long-term livability rather than short-term shine—better insulation, durable finishes, and efficient fixtures often pay you back every month. If you’re investing, run exit scenarios: hold and rent with reserves for capital expenses, or sell based on recent, comparable closings rather than the rosiest listing. Either way, remember that the real win is not squeezing every dollar from a single deal but building repeatable processes.

Conclusion and next steps: Foreclosed homes reward preparation, patience, and integrity. You’ve learned how to read the pipeline, organize due diligence, align financing with timelines, and move confidently from contract to keys. Start small, track your numbers, and refine your approach with every walk-through and repair order. With a clear framework and realistic expectations, you can turn distressed listings into opportunities that fit your budget, your calendar, and your goals.